Crypto Week 7 Summary

Good, bad, and flat.

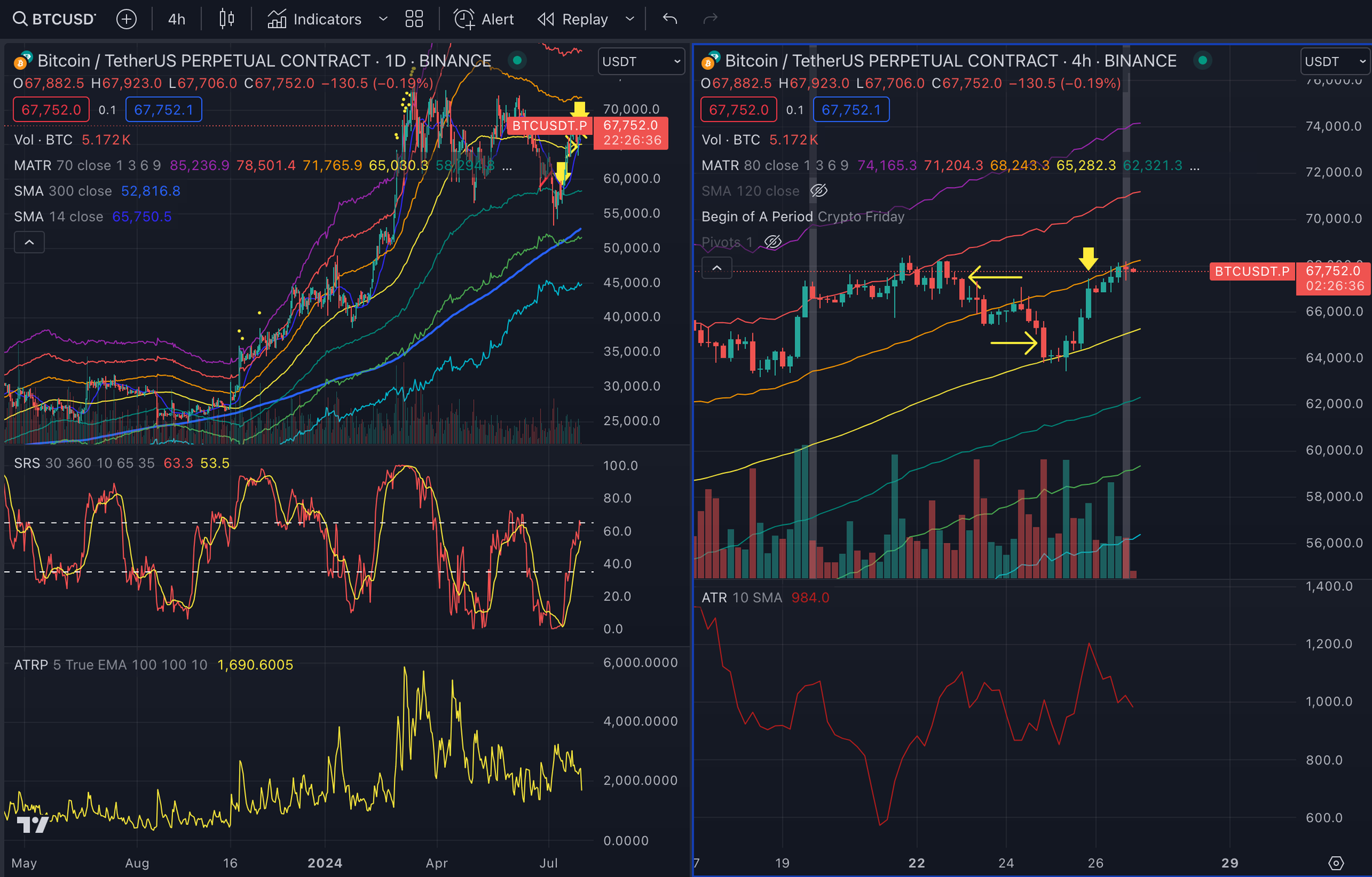

Object: BTC Perp (5x).

Amplitude of the move in the object: +1.1%

Return: +2.1% (before commission); +1.% (after commission)

Equity: 0.66.

Some notion:

Tracking weekly returns is quite challenging, especially when new funds are injected intermittently. I'm not particularly concerned with calculating the equity curve relative to the initial investment because, ultimately, the initial amount matters less to me. What truly matters is the return on the money I've actively deployed. Therefore, rather than meticulously reporting each week's return, I will concentrate on assessing the equity relative to the total amount of money I've utilized in the following weeks. This approach aligns better with what I genuinely care about—maximizing the effectiveness of the capital I engage.

Narrative on the market:

The market isn't actually that bad. The long-term trend is still down, while the intermediate trend is up. I choose to stick with the short side.

On July 23, I found the price was rejected by the MATR80+6ATR. The expectation was for two ATR clouds. I shorted at 67,400 with 1/3 of my regular exposure, setting a stop loss at 68,500. The ride was perfect, and I closed out my position at 64,625 when the price hit the MATR cloud. This trade increased my account by 6%. The trade is indicated by two yellow arrows pointing left and right.

The other trade, which I still hold, is a short position entered at 66,870 with full exposure. This trade currently shows a loss of around 4% of my account. The issue is that I did not wait for confirmation and neglected the uptrend of the daily SMA15. The stop loss is set at 68,300, and the target is 62,000.