Crypto Week 9 Summary

A BTC-Branded Roller Coaster!

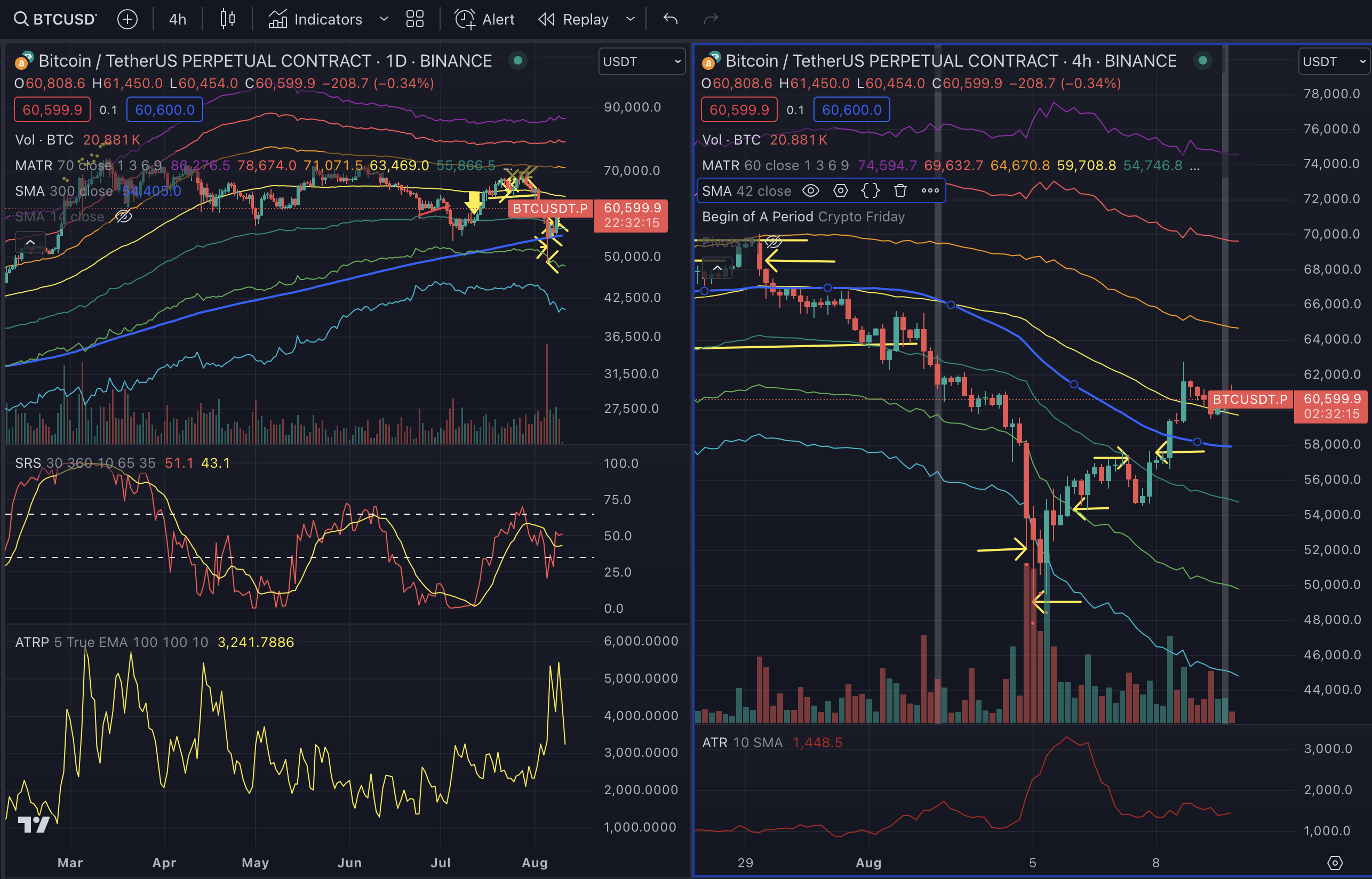

Object: BTC Perp (5x).

Amplitude of the move in the object: -3.20%

Return: +17.19% (before commission); +16.19% (after commission)

Equity: 0.84.

What a Wild Week in the Market!

This week was a roller coaster for BTC, with the price dropping from 62,620 to 48,888, only to make a V-shaped recovery back to 60,649—all within a single week! Interestingly, BTC's behavior is starting to resemble that of US stock index futures.

My Trading Journey This Week:

- Short Position Success: I held onto my short position from last week and took profits at 52K when the price hit 10ATR. This trade netted me a profit of around 15%, which constituted the majority of my gains for the week.

- Navigating the Panic: Despite the market's panic, I wasn't sure where it would head next. I placed a limit buy at 49K and called it a night. The next day, I found my order had been filled, so I set my target at 54K (6ATR). The market's volatility quickly hit the target within a few hours, resulting in a 3% profit.

- A Short That Didn’t Pan Out: I decided to short the market again when I saw the price being rejected at 3ATR, around 56K. My target was 53K, but this trade didn’t work out as planned. I exited at 58K, taking a 1% loss.

Some friends have asked why my trade profits are approximate figures. Here are the reasons:

- Scaling In and Out: I typically scale in and out of positions along the trend, and I don't always log every detail in real-time.

- No Reference Number Logging: I also don't log the exact reference numbers for my positions before I enter a trade. As long as I'm making money or keeping losses small, I believe my account will be fine.

Current Position: Flat.